ev tax credit bill date

37 votes 26 comments. Ad Tax credits for electric cars.

How Does The Electric Car Tax Credit Work U S News

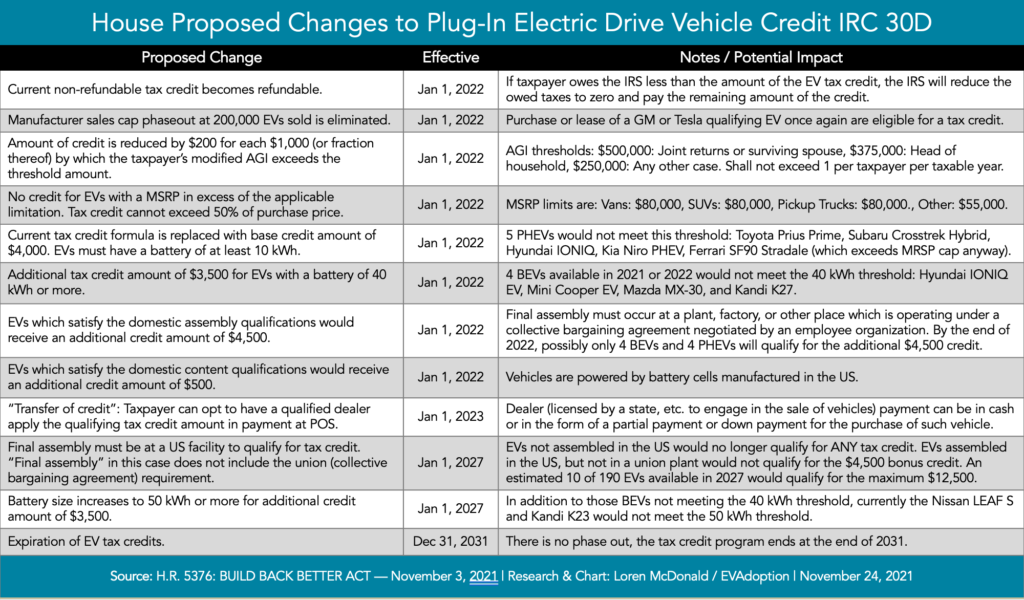

In addition the bill modifies the credit to remove the limitation on the number of.

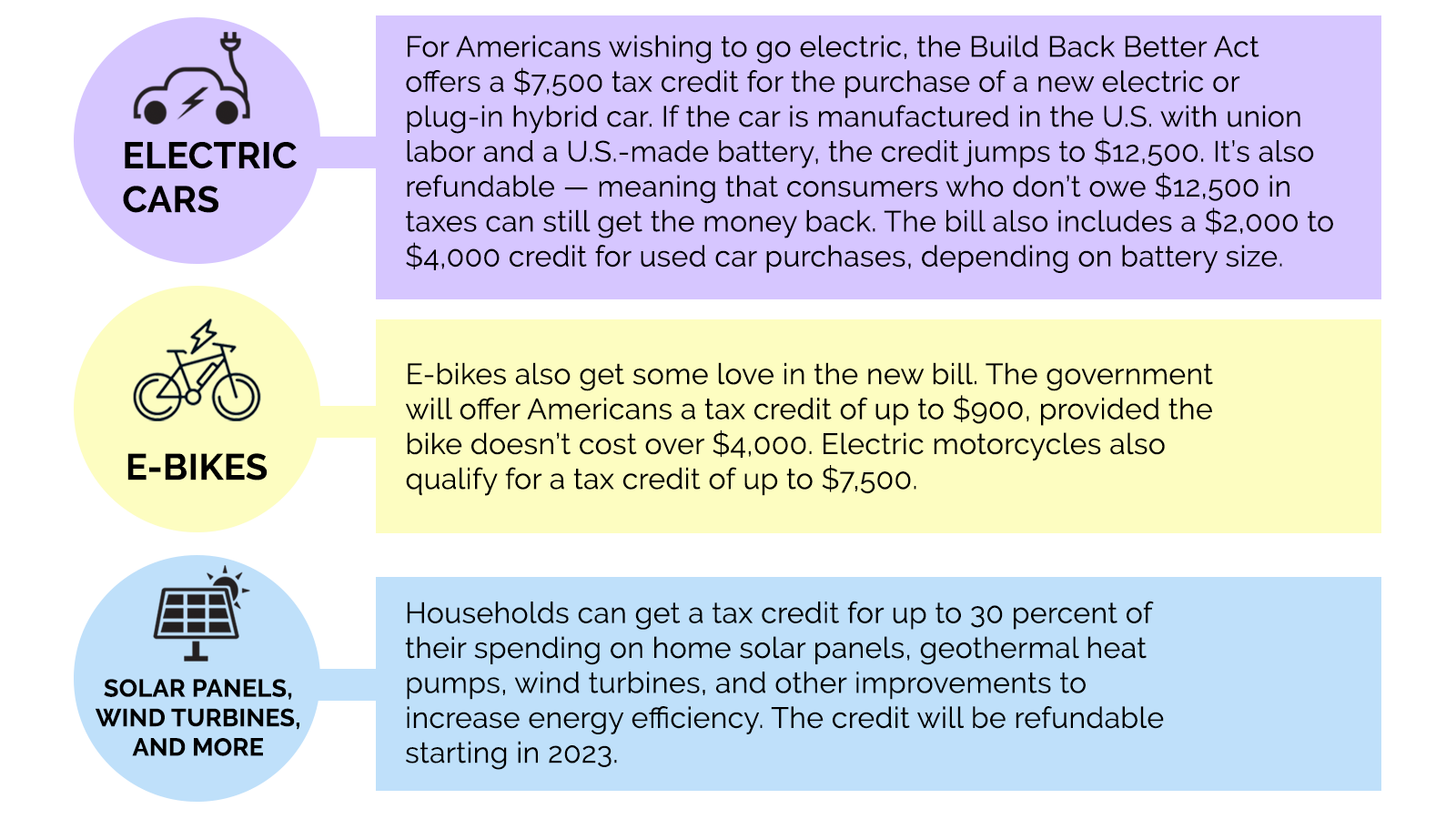

. For vehicles acquired after December. The EV tax credit proposed by Biden and other Democrats would be an increase from the current 7500 credit to a maximum of 12500. In spite of Republican opposition Senate Democrats are working to make changes to the EV tax credit which would increase the credits value to 12500.

August 10 2022 at 1209 pm. Colorado EV Tax Credits. 1 day agoJapan warned the United States over the weekend that the latters electric vehicle tax credits could dissuade them from investing in the worlds largest economy.

First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10 yearsuntil December. The bill extends the tax credit for new qualified plug-in electric drive motor vehicles through 2031. What the new electric vehicle credits mean for you.

However only specific types of. Updated information for consumers as of August 16 2022 New Final Assembly Requirement If you are interested in claiming the tax credit available under section 30D EV. If signed into law the bill would require EVs by 2024 to have batteries made with at least 40 percent minerals extracted or processed by a nation that is party to a US.

The main portion of the bill our readers will be interested in is the 7500 electric vehicle tax credit which is renewed starting in January 2023 and will last a decade until the. Browse Our Collection and Pick the Best Offers. The timeline to qualify for an EV tax credit extends to December 2032.

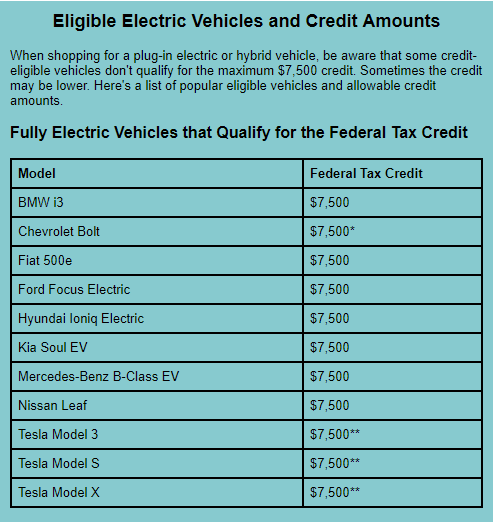

Check Out the Latest Info. Almost all electric vehicles would qualify for the US EV tax credit with new Congress bill. The 200000 EV tax credit cap is eliminated which makes some Tesla GM and Toyota cars eligible again.

Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. If the legislation passes it would delay the battery sourcing provision until 2025 and the final assembly requirement until 2026. If you buy or convert a light-duty EV in Colorado you may be eligible for a 2500 tax credit 1500 for leasing in 2022.

With the nations most significant climate bill likely to become law. Tax Credits For Electric Cars. 2 days agoA new bill introduced in the US Congress called the Affordable Electric Vehicles for America Act would allow essentially all EVs in the US to qualify for the 7500 tax credit if passed.

Those adjustments would allow Hyundai. It will bring the tax credit back for Tesla GM Toyota and all other EV automakers but only if. The 200000 sale cap is replaced with an expiration date of December 31 2032.

Then I would recommend waiting until January 2023 when a lot more slightly more affordable EVs like the Chevy Bolt EUV and Tesla Model 3 will be newly available for the credit. Finally the US Senate has passed a bill with an updated 7500 EV tax credit and it has plenty of promise though it seems most EVs wont initially qualify.

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

The New Ev Tax Credits Explained Wetm Mytwintiers Com

Us Senate Passes Huge Climate Bill With Updated Ev Tax Credit

Exclusive U S Automaker Ceos Toyota Urge Congress To Lift Ev Tax Credit Cap Reuters

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Revamping The Federal Ev Tax Credit Could Help Average Car Buyers Combat Record Gasoline Prices International Council On Clean Transportation

Here Are The Cars Eligible For The 7 500 Ev Tax Credit In The Inflation Reduction Act Electrek

What To Know About The Complicated Tax Credit For Electric Cars Npr

Electric Vehicle Tax Credit You Can Still Save Greenbacks For Going Green Pkf Mueller

Changes Are Coming For Ev Tax Credits Should You Buy An Electric Car Now

Green Incentives Usually Help The Rich Here S How The Build Back Better Act Could Change That Grist

Inflation Reduction Act Extends 7 500 Tax Credit For Electric Cars

Ev Tax Credit Boost At Up To 12 500 Here S How The Two Versions Compare

Ev Tax Credits On The Table As Democrats Try Reviving Parts Of Build Back Better The Hill

Electric Vehicle Tax Credit Complete Guide 2022 Update

Inflation Reduction Act Ev Tax Credit Ev Buyers Receive Up To 7 500

Proposed Changes To The Federal Ev Tax Credit Passed By The House Of Representatives Evadoption